On 26 November 2019, the Financial Stability Board (FSB) published a revised version of its “Regulatory Framework for Haircuts on Non-Centrally Cleared Securities Financing Transactions” (2019 Framework).

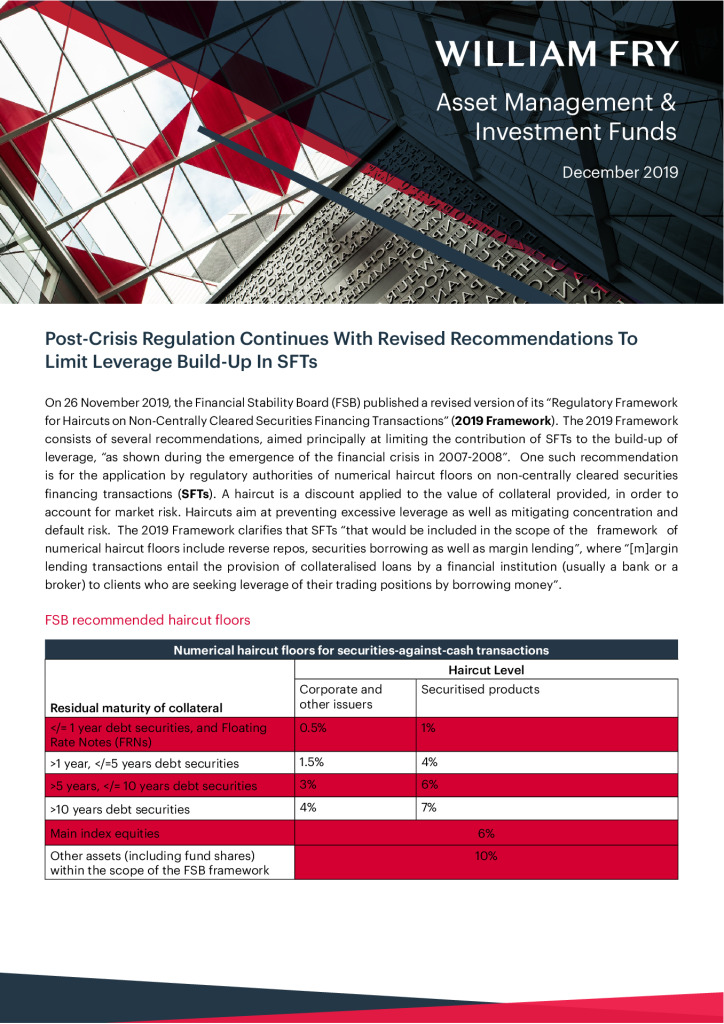

The 2019 Framework consists of several recommendations, aimed principally at limiting the contribution of SFTs to the build-up of leverage, “as shown during the emergence of the financial crisis in 2007-2008”. One such recommendation is for the application by regulatory authorities of numerical haircut floors on non-centrally cleared securities financing transactions (SFTs) including reverse repos, securities borrowing as well as margin lending.

Despite stakeholders request, investment funds have not been excluded from the scope of the 2019 Framework.

Click below to read our full briefing.

Contributed by: Nessa Joyce

Recommended Insights