PE investors, both international and domestic, continue to take a keen interest in Irish businesses – and the sector retains significant sums of dry powder to invest.

Nevertheless, PE dealmaking has slowed worldwide in recent months, and Ireland has not been immune to that shift.

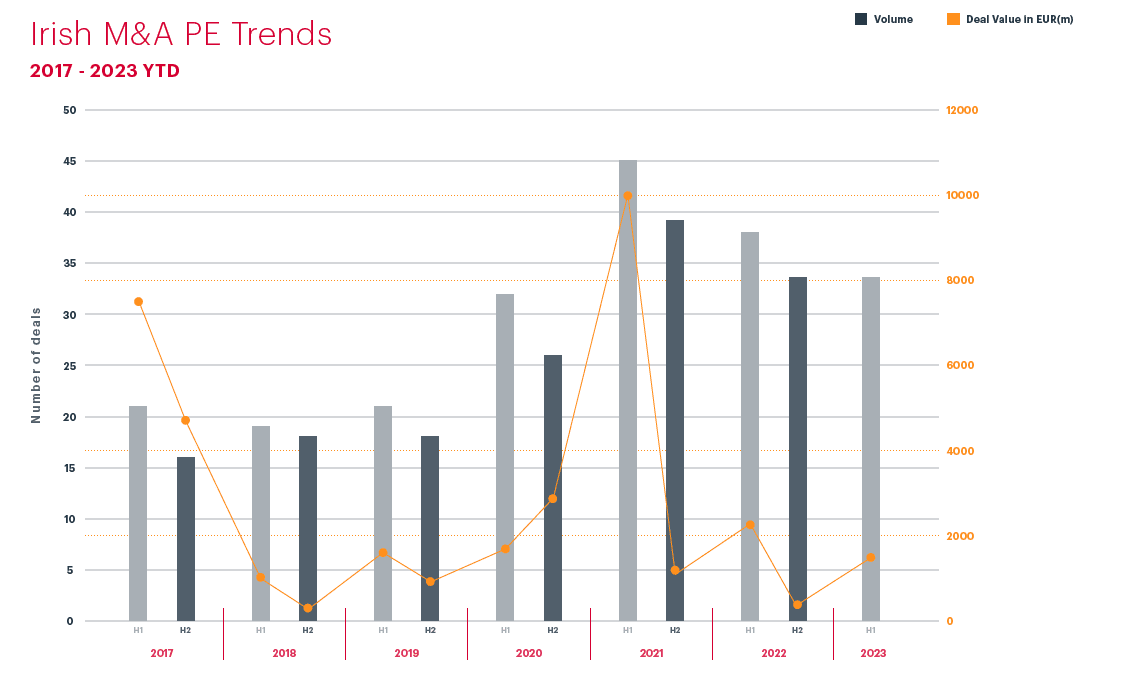

Overall, the first half of 2023 saw 34 Irish M&A transactions involving a PE interest, worth €1.69bn in aggregate. That marks a 11% and 32% decline in volume and value terms YoY.

Five of the top 20 largest deals by value were PE-related transactions, including two of the top three deals. The sale of Enva Ireland by Exponent Private Equity to I Squared Capital was an all-PE deal, while UKG’s purchase of Immedis saw Scottish Equity Partners and Lead Edge Capital sell their stake in the business.

There has also been notable buy-out activity. In the largest such deal of the year to date, Crosspoint Capital Partners, which has a particular focus on the cybersecurity, privacy and infrastructure software markets, acquired an undisclosed stake in Everseen, as part of the firm’s €65m series A funding round. Everseen develops software for reducing theft at self-checkout points in retailers.

Given the substantial capital firepower of PE investors which has yet to be deployed, there will be further deals to come in 2023, but some investors report frustration that sellers’ expectations on valuation have not yet adjusted to reflect the realities of prices in listed markets. That pressure is particularly acute in industries such as TMT, where the sell-off of shares in public technology companies has been especially marked in the recent past.

Inevitably, business owners and founders will take some time to become accustomed to the idea of lower valuations compared to those seen in recent years, but as those expectations do shift, PE investors have the capital and the appetite to do more deals.

Click the image below for the full M&A Half Year Review 2023.

Recommended Insights