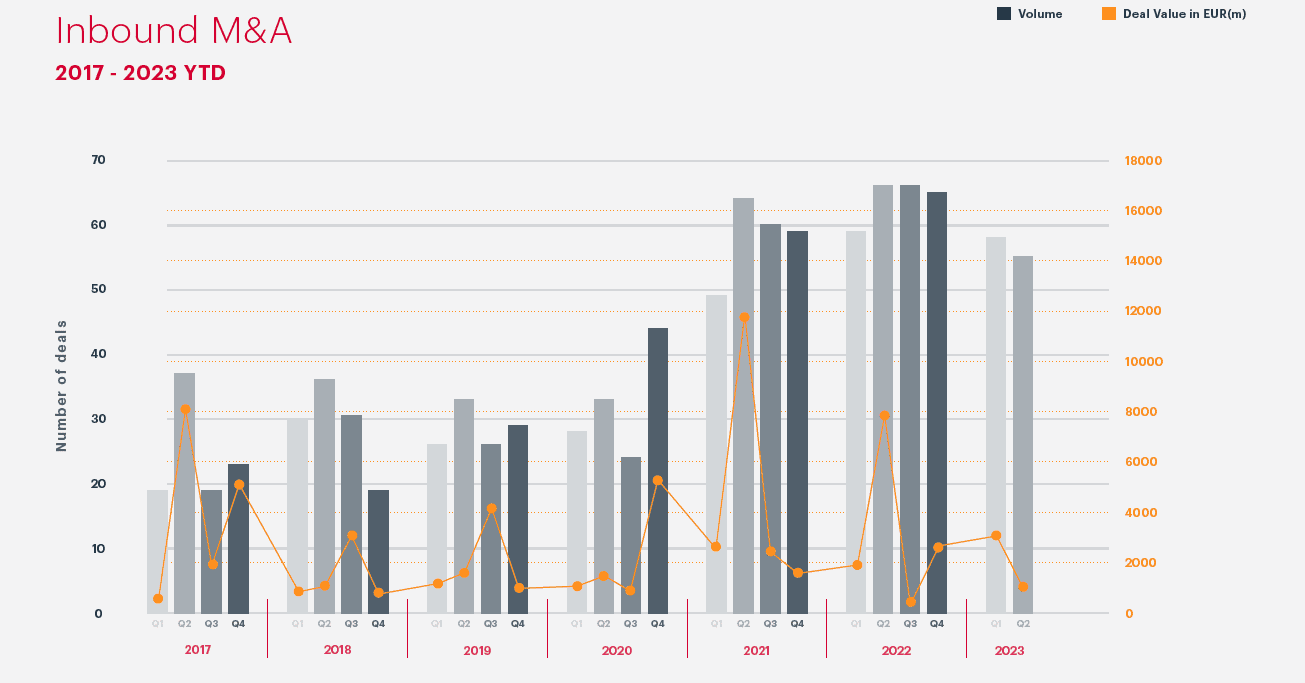

As in previous years, a significant percentage of M&A activity in Ireland in the first half of 2023 involved international acquirers.

Inbound activity is reduced YoY, in line with the overall market, but still accounts for almost over two-thirds of Irish M&A deals in H1 2023 – 113 of the total 177 – and that includes 16 of the 20 largest transactions.

Clearly, Ireland remains an attractive destination for international buyers and investors, offering a strong economy and a crucial foothold in the European Union (EU). As a gateway market into the EU for companies from the US and, in the wake of Brexit, the UK, Ireland remains well-placed for attracting new foreign direct investment.

Unsurprisingly, acquirers from the US and the UK accounted for a significant share of overseas interest in Irish targets. UK acquirers agreed 43 deals in the first half of the year, with US acquirers responsible for a further 28. Acquirers from Sweden and the Netherlands, accounting for five deals respectively, were the next most active in the first half of the year.

That said, the largest deal by value was the acquisition of Irish head-quartered Amryt Pharma by Chiesi Farmaceutici for €1.343bn. As a result, Italian acquirers were the most active overseas players in the Irish market by value during this period, accounting for €1.9bn worth of transactions.

Acquirers from the US, on €1.1bn, and the UK, on €449m, came next in value terms. Many of the deals involving acquirers from those countries were relatively small. One significant source of deal work continues to be the indirect acquisition of Irish subsidiaries by overseas buyers as part of their acquisition of international parent companies.

As for domestic deals, there have been 64 transactions announced thus far in 2023, versus 55 during the same period last year. Domestic deal values reduced from €2.2bn in the first six months of 2022 to €1.1bn this year.

Click the image below for the full M&A Half Year Review 2023.

Recommended Insights