M&A in Ireland is an international story

Around two-thirds of the deals in 2023 involved an overseas bidder (67%), with 225 inbound transactions overall. Those deals were collectively valued at €11.3bn – 96% of the market. Indeed, 19 of the 20 largest deals in Ireland during 2023 were cross-border transactions.

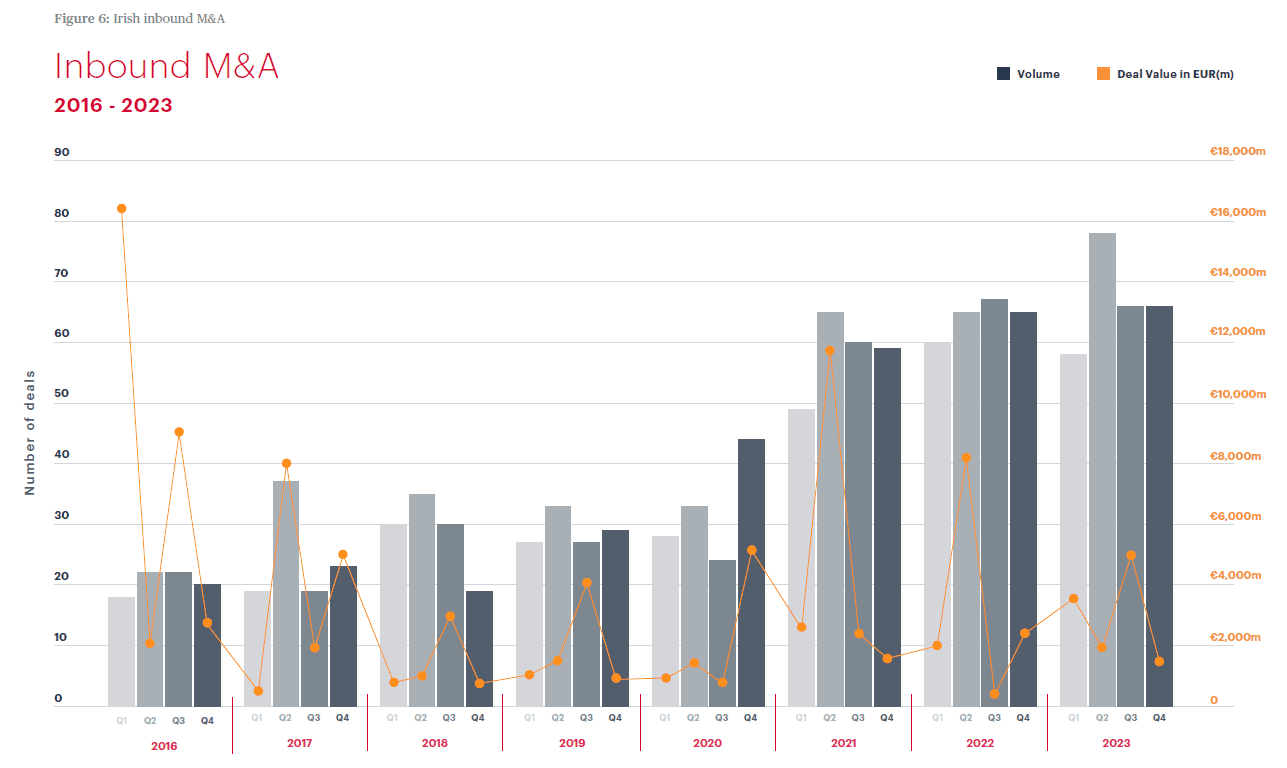

That said, inbound interest in Ireland did ease back slightly in 2023 – the figures were down 12% in value terms, albeit up 2% by volume compared with 2022. That was to be expected, given a global slowdown in M&A activity. But, as Figure 6 shows, the number of bids for Irish companies by international acquirers in 2023 remained very healthy by historical standards. Inbound deal volumes remain well ahead of anything seen before 2021.

Ireland’s attractiveness to overseas bidders reflects both the merits of the country itself – particularly given its competitiveness, as its economy has been performing better than most other European countries over the past couple of years – and its value as a gateway to European Union markets. The fact that more Irish companies have an international footprint these days provides an increasingly compelling story for bidders from all around the world, both trade acquirers and PE investors.

In volume terms, UK-based acquirers were the most active bidders for Irish companies during 2023, accounting for 80 transactions. US acquirers also continued to demonstrate their appetite for Irish companies, with 50 deals over the year. In value terms, bidders from Saudi Arabia and the US were responsible for more M&A activity than any others, at €3.3bn and €2.8bn, respectively.

On the domestic front, it is interesting to note that the number of deals between Irish parties rose by 30% in 2023, boosting the overall M&A data. There were 109 such deals in 2023, compared with 84 the previous year. The largest domestic transaction took place in the TMT sector, where Cordiant Digital Infrastructure paid €191m to acquire Speed Fibre Group from AMP Capital’s Irish Infrastructure Fund.

Click on the image below to download William Fry’s M&A Review for 2023

Recommended Insights