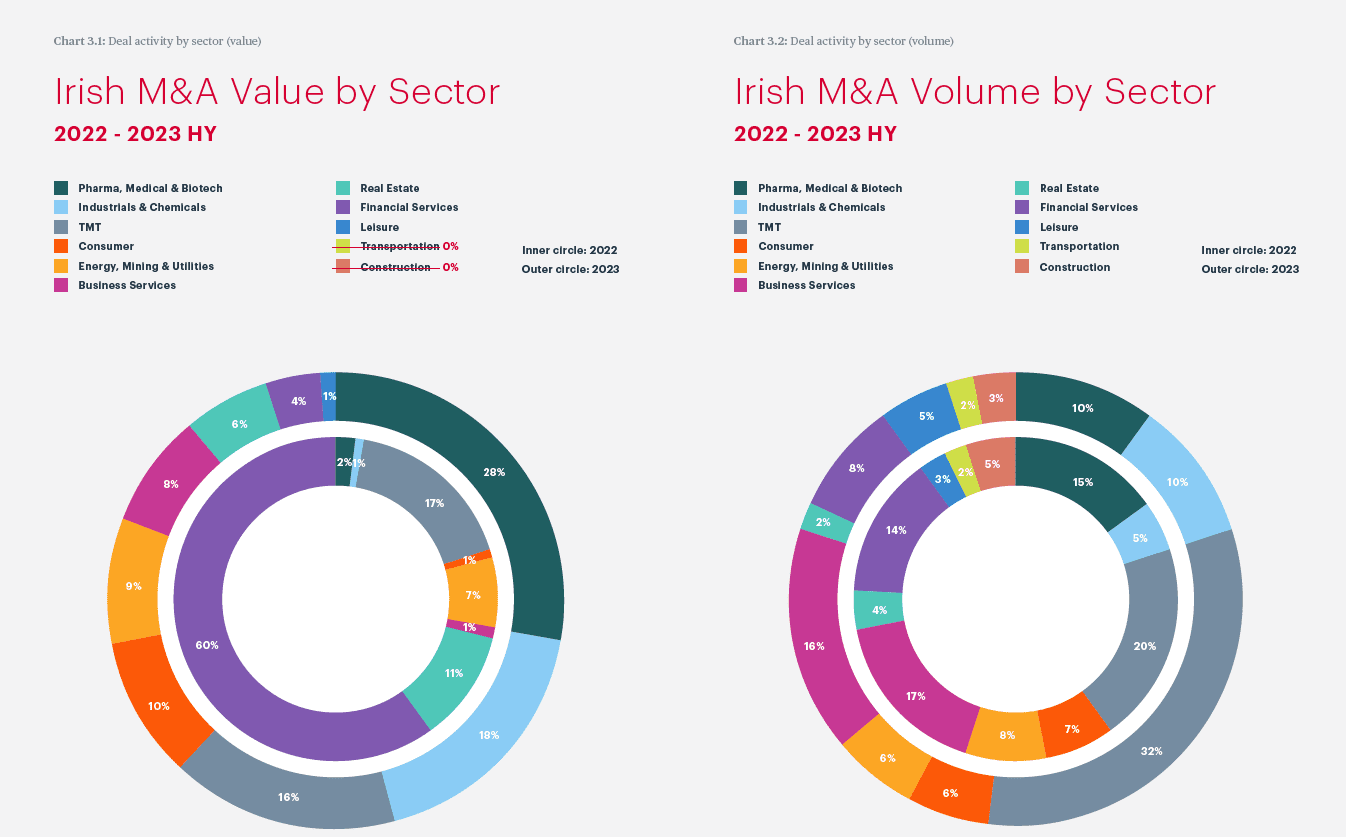

With only a handful of very large deals in H1 2023, the sectors in which these took place were inevitably the most dominant, at least by value.

The pharmaceuticals, medical and biotech (PMB) sector accounted for 28% of Irish M&A activity by value in the first half of the year, versus just 2% during the same period last year. That was not entirely down to the inclusion of Chiesi Farmaceutici’s acquisition of Irish head-quartered Amryt Pharma, but that deal was by far the largest of the dozen PMB transactions seen in the first half of the year.

Industrials & Chemicals, meanwhile, was the next most active sector by value, accounting for 18% of Irish M&A activity in the first half of the year, up from just 1% during the same period last year. In part, this reflects the sizeable Enva Ireland transaction, but Industrials & Chemicals was also the fourth most active sector by volume, with 18 deals announced in H1 2023.

We have also seen an increase in consolidation activity in the professional services subsector, a relatively new trend in Ireland. Areas such as audit and legal services are beginning to see a wave of M&A activity, mirroring similar activity in markets such as the UK.

TMT saw 56 transactions announced in the first half of the year, up on last year’s first-half total of 36. In all, TMT deals accounted for 32% of H1 2023 deal activity by volume.

Many of the TMT transactions were relatively low value, with acquirers looking to add specific competencies or tools to their businesses, particularly as digital transformation continues to sweep through a variety of industries. M&A activity often provides a short-cut to innovation in this regard.

By contrast, M&A activity in financial services fell back sharply in the first half of 2023, with just 14 deals worth €190m in aggregate (compared to 25 deals worth €7.40bn in the first half of 2022). While there is still some activity at the smaller end of the sector – including ongoing appetite for financial technology (fintech) players – trends that have dominated in recent years, such as insurance company consolidation, appear to have lost some of their momentum.

Other sectors to note include energy, where Arjun Infrastructure Partners’ deal to take a 30% stake in Amarenco Solar required an investment of €300m. Further consolidation in this part of the market is likely as the focus on decarbonisation intensifies, even if overall energy sector M&A activity was down in the first half of the year.

Similarly, while deal activity in the leisure sector has been muted, this may pick up in H2 2023 if higher interest rates persist. Inevitably, this will put pressure on operators in sub-sectors such as hotels, which is likely to lead to consolidation.

Click the image below for the full M&A Half Year Review 2023.

Recommended Insights