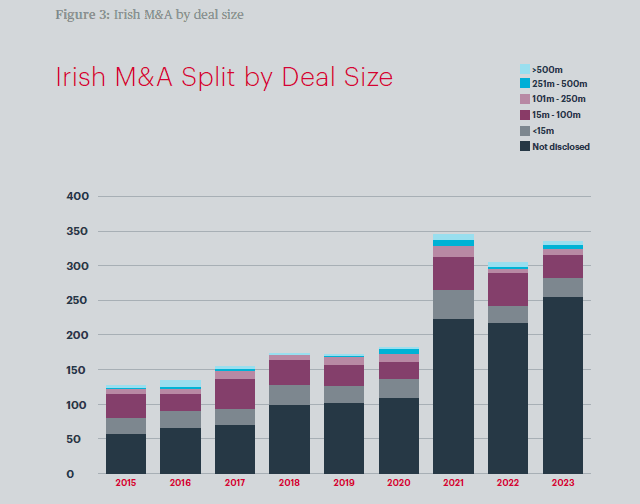

Ireland’s M&A market has traditionally been dominated by mid-market activity and this trend continued in 2023.

86% of deals announced with deal values disclosed publicly were worth between €5m and €250m (Figure 3). Eleven transactions were larger, including five worth more than €500m, which is broadly in line with the data of the past few years.

On deal numbers, the technology, media and telecoms (TMT) sector has been dominant, accounting for 25% of all transactions announced, up marginally from 24% in 2022. However, many of these deals were relatively small; five TMT sector transactions made the top 20 Irish deals of the year by size.

By contrast, the financial services sector recorded fewer transactions overall during 2023, but was the most active area for M&A by value, accounting for 35% of all Irish deals. In large part, that reflected the €3.3bn AviLease paid Standard Chartered bank to acquire Pembroke.

The second-largest deal of the year, the sale of Amryt Pharma to Chiesi Farmaceutici of Italy, was worth almost €2bn less than the top deal, and only one other pharma, medical and biotech (PMB) transaction made it into the top 20 deals of the year. Nevertheless, the sector still accounted for 15% of Irish M&A by deal value, underlining the extent to which a few large transactions stand out in a market dominated by smaller transactions.

Another notable theme of 2023 in the Irish M&A market has been the much more limited participation of the private equity (PE) sector, which has been a significant driver of deal activity in recent years. Over 2023, PE buyers accounted for €2.2bn of deal activity, 33% less than in 2022, mirroring global trends. In volume terms, PE transactions in Ireland were down by 11% compared with 2022, contrary to the year-on- year uptick in volume seen in the rest of the M&A market.

PE firms have not disappeared from the Irish market and continue to account for some sizeable transactions – infrastructure investor I Squared Capital’s acquisition of Enva Ireland, the Irish waste recycling and processing services business, for example, was worth €779m. Nevertheless, in an era of higher interest rates, higher acquisition finance costs have inhibited PE firms. Certainly, their ability to match sellers’ valuations has been diminished; corporate bidders, by contrast, may feel able to bridge the gap.

Click on the image below to download William Fry’s M&A Review for 2023

Recommended Insights